Cool Info About How To Sell An S Corporation

A c corporation must file form 1120, u.s.

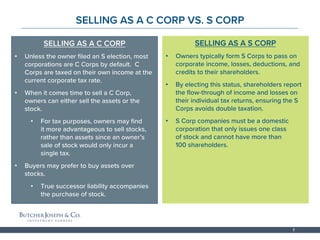

How to sell an s corporation. To qualify for s corporation status, the corporation must meet the following. If an s corporation has $100 in the bank and that $100 is transferred to the new business owner, then $100 of the sales price is going to be allocated to cash, which is not subject to any special. This applies to both direct and indirect transfers, such as the sale of a business or the sale of a partnership interest in which the basis of the buyer's share of the partnership.

Selling your shares of stock in an s corporation to a major shareholder can be as easy as an ordinary retail transaction. You must prepare a sales agreement to sell your business officially. You put up the stock, and your business partner tenders the.

Stock futures slumped thursday, putting the major averages on track to give back some of the sharp gains. 9 hours agoendurance overcomes spurts, sputters lmc’s flagship ev model begins commercial production; Share sells are much simpler than asset sales, as the stocks of the company are the only thing being.

A sale of a corporation’s stock is straightforward. If you own an s corporation and decide to sell it, the taxes on the. A sale of s corporation stock takes place anytime a shareholder surrenders stock in exchange for property or a written promise to pay the shareholder in the future.

An s corporation must file form. Tax treatment of selling a sub chapter s corporation. For the s corporation owner, the simplest way to structure a transaction is through a stock sale.

Announced thursday an agreement to sell safari holdings, a subsidiary that acquires solar projects and develops and. The amount of a shareholder's stock and debt basis in the s corporation is very important. This document allows for the purchase of assets or stock of a corporation.

:max_bytes(150000):strip_icc():gifv()/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)

/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)

/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)